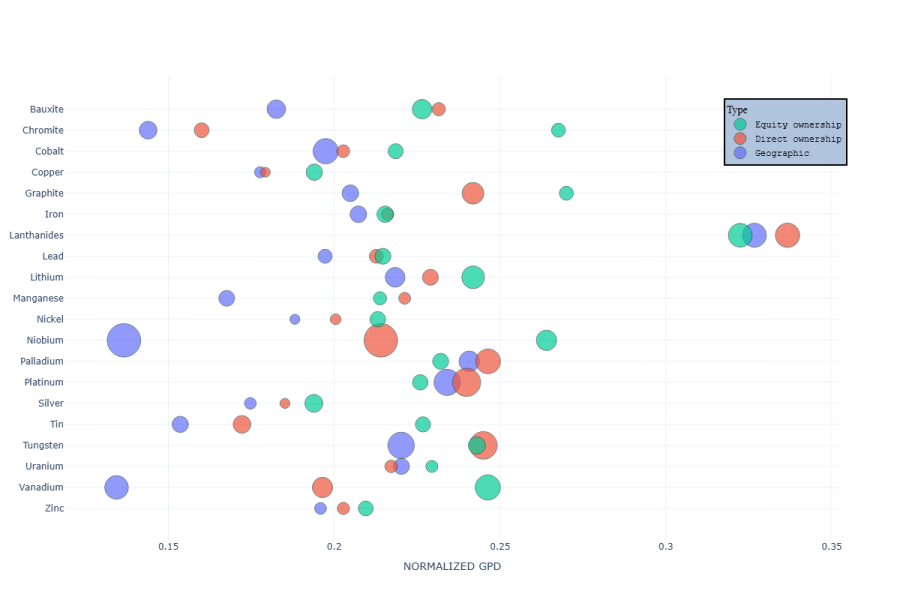

GRAPH - The Geopolitical Dimensions of Critical Mineral Control

As the global energy transition accelerates, the demand for critical minerals is surging, along with concerns over who controls their production. While geographic concentration is often discussed, less attention is paid to the ownership structures behind mining assets. This graph explores how different dimensions of control (geographic location, direct corporate ownership, and equity ownership) affect the geopolitical landscape of mineral supply.

Graph of the Month April 2025

Graph of the Month April 2025

This graph compares the concentration of the world critical mineral production using three dimensions of control: Geographic (assigned to the country where the mine is located), Direct Ownership (assigned to the country of the mining company’s headquarters), and Equity Ownership (assigned to the country of the mining company’s owners). It also incorporates the average Geopolitical Distance (GPD) of the controlling countries.

Each mineral is represented by three dots (one per control measure) on the Y-axis, with dot size proportional to the Herfindahl-Hirschman Index (HHI) concentration score. The X-axis represents the normalized average GPD of producers for each mineral, where higher GPD values indicate that the controlling countries are, on average, more geopolitically distant from the rest of the world.

On average, producers identified by direct and equity ownership have a higher average Geopolitical Distance from the rest of the world compared to geographic producers. This suggests that the host countries of critical mining assets are generally less geopolitically distant than the institutional owners. These host countries often include nations in Latin America and Africa, which have some of the lowest GPD scores. Conversely, high levels of production control frequently involve a significant proportion of countries aligned with specific geopolitical blocs, which tend to have higher average GPD values relative to the rest of the world. In other words, the high and overlooked level of concentration in the ownership structure of some critical mineral mining assets increases geo-economic risk, which can amplify vulnerabilities in global supply chains.